Term Life Insurance That Pays If You Are Terminally Ill

Term life insurance that pays you if you’re terminally ill is a concept we’re proud to bring to our clients at Rettino Insurance Group, as...Continue reading→

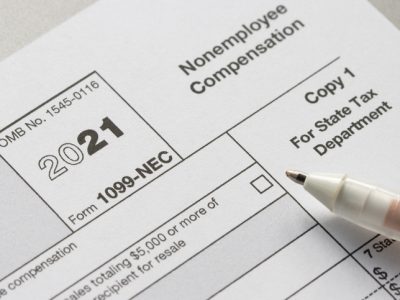

The Difference Between Employees and Contractors

Many companies take advantage of the convenience and expertise of independent contractors, but benefiting from workers who aren’t on your payroll comes with risks. Those...Continue reading→

Reputational Harm from Social Media

Has social media caused reputational harm to your business? With social platforms at our fingertips, we have the ability to post what is on our...Continue reading→

Personal Coverage Isn’t for Home-Based Businesses

Many people think that their personal insurance coverage will cover their home-based business. It does not. Continued advances in technology make it easier for business...Continue reading→

Grill with safety in mind this Memorial Day weekend

Often considered the unofficial kick-off to summer, Memorial Day weekend includes lots of celebrations featuring cookouts and barbeques. But it also means the increased risk...Continue reading→

Businesses Should Take Control of Their Fleet Program

Businesses that have an over-the-road exposure should take control of their fleet program. A dedicated fleet supervisor can help employees understand what is expected of...Continue reading→

Adult Children Living at Home

Do you have adult children living at home? Are you concerned that they may not be respecting your rules and personal space? Our friends at...Continue reading→

Why Nonprofits Need Insurance

Yes. Nonprofits need insurance. It is important that nonprofits do a thorough evaluation of their insurance needs, because precious funds can be lost if they...Continue reading→

A BOP May Be the Right Fit

The business owners policy (BOP) may be one of the insurance industry’s most versatile insurance policies and just the right protection for your small business....Continue reading→

Tips to Reduce Winter Slips and Falls

Winter typically brings its own hazards to businesses. Reducing the chance of slips and falls accidents should keep your liability losses down and improve your...Continue reading→

Should I Buy Business Insurance Online?

No. As a small-business owner, you undoubtedly receive advertising offering the “ease” of buying insurance online and promising lower rates. Literally thousands of insurers today...Continue reading→

Promptly Reporting Accidents to Your Workers Compensation Carrier

When employees are injured at work, promptly reporting accidents to your workers compensation carrier is imperative. Even if you don’t think an incident occurred as...Continue reading→

General Liability offers Broad Basic Insurance Protection

Business owners need protection against a broad swath of liability claims. General liability (GL) insurance offers just that. Here are some examples of coverage you...Continue reading→

EPLI – Employment Practices Liability Insurance

Employment practices liability insurance (EPLI) helps pay for legal defense and claims payments related to sexual harassment, wrongful termination, and discrimination. Some insurers also offer...Continue reading→

Business Interruption from Floods

The risk of flooding to your building may be far greater than you think. Flood maps are outdated, conditions that increase flood damage may now...Continue reading→

Employee Emails, Yes, You Can Look at Them

You can look at employee emails or any email on your own systems or servers. With electronic communications now serving a predominant role in business...Continue reading→

How Subrogation Waivers for Subcontractors Work

Are you being asked to include subrogation waivers in a contract with a job partner, service provider or contractor? These waivers are common nowadays, but...Continue reading→

No Claim Adjuster Will Visit You

If you have a property loss, you might be surprised when your insurer asks you to handle the claim’s adjustment. It is increasingly common for...Continue reading→

Don’t Let Sign Breakage Break You

Got an expensive sign outside your business? While business owners policies and commercial property policies provide some coverage for signage, it’s usually for signs that...Continue reading→

Snow Removal Liability Concerns

Snow removal companies need to have proper coverages in place. Poor coverage for snow removal businesses can cost you. When you’re plowing snow, the last...Continue reading→

Copying Photos from Google and Using Them

You went online and found a clever image, video or copyrighted text that works perfectly with your business’s new marketing campaign. Can you simply start...Continue reading→

Is Your Property Valuation Current?

Have you had a recent property valuation? Material costs are rising and your property coverage needs to keep up with inflation and inflation is at...Continue reading→

Crisis Response Coverage for Businesses

Crisis response coverage is a little known coverage that could help get your business back on traffic after a tragedy. With all the violence...Continue reading→

Weatherproof Properties to Reduce Damage

Here are some tips to help prevent weather damage to your properties. Inspect your building for cracks and seal above-grade exposures. Water seepage can cause...Continue reading→